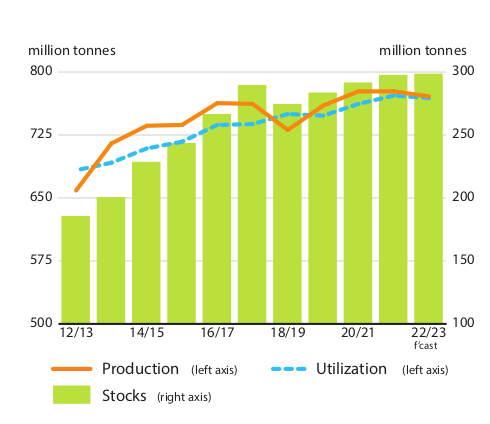

Wheat production, utilization and stock in 2022/23 season

Global wheat markets are embarking on the 2022/23 season with a great deal of uncertainty. The impacts of the ongoing war in Ukraine, trade policy changes in several countries, and high international prices will shape much of the wheat market outlook. International wheat prices are at levels not reached since 2008, following a season of tight global availability due to reduced harvests in some major exporting countries and export suspensions by others, including Ukraine (a major exporter) and India (an emerging exporter), along with supply concerns for 2022/23 also adding pressure.

Global wheat production in 2022 is predicted to decline from the 2021 record level by 0.8 percent, reaching 771 million tonnes and marking the first drop in four years. Year-on-year falls in production in Australia, India, Morocco and Ukraine will likely outweigh expected increases in Canada, the Islamic Republic of Iran and the Russian Federation.

While world food consumption of wheat is projected to expand, albeit at a below-average pace, a decrease in the feed use, driven by high prices and, to a lesser extent, industrial use of wheat is anticipated to cause a 0.4-percent decline in total wheat utilization in 2022/23 to 769 million tonnes. This would be 1.1 percent below the ten-year trend, marking the first time in three years that global utilization has fallen below the trend.

With global production in 2022 preliminarily forecast to exceed utilization in 2022/23, world wheat stocks are set to increase marginally, by 0.4 percent, to 298 million tonnes by the close of the seasons in 2023. However, much of that increase is foreseen to be concentrated in China, the Russian Federation and Ukraine, while stock drawdowns are anticipated in several countries in Africa and Asia.

At 189 million tonnes, the preliminary forecast for world trade in wheat (including wheat flour in wheat equivalent) in 2022/23 (July/June) points to a 1.7-percent decline from the 2021/22 level. The contraction mainly stems from an anticipated significant reduction in exports from Ukraine as a result of the blockade of its ports by the Russian Federation.

Smaller shipments are also forecast for Argentina, Australia and India, stemming from lower production on top of an export ban in India. On the import side, smaller purchases by several countries in Asia, especially China and Iran, are seen lowering global import demand.