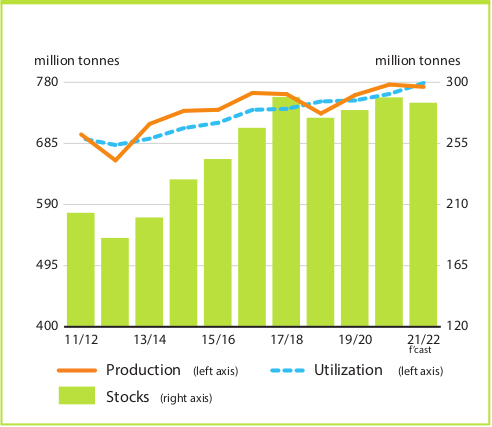

FAO’s 2021 global wheat production, utilization and stocks forecast

An expected decline in global production against rising demand is seen tightening the global wheat market further in 2021/22, as evidenced by the multiyear high price levels maintained since the start of the year.

At 770.4 million tonnes, FAO’s 2021 global wheat production forecast now points to a 0.8 percent decline from the 2020 record primarily attributed to lower outputs expected in Canada, the Russian Federation and the United States of America (the United States), as well as several countries in the Near East. Total wheat utilization is expected to reach nearly 779 million tonnes in 2021/22, 2.2 percent higher than in 2020/21. Global food consumption of wheat is seen rising in tandem with population growth, while strong growth in feed use is anticipated, especially in the European Union, but also in China, India, the United Kingdom of Great Britain and Northern Ireland and the United States, mostly due to higher production and firm feed demand.

With overall utilization forecast to exceed world production, global wheat inventories are set to fall by 2.2 percent below their opening level to 282.1 million tonnes. The forecast drawdown is mostly concentrated among major exporters, especially Canada, the Russian Federation and the United States, on lower harvest prospects.

Consequently, the ratio of major wheat exporters’ closing stocks to their total disappearance (defined as domestic utilization plus exports) is expected to fall to 12.5 percent, its lowest level in more than two decades, indicating tighter global market conditions and keeping prices 29.1 percent higher in the period from January to October 2021compared to the corresponding period in 2020.

World wheat trade is forecast to expand by 1.8 percent in 2021/22 (July/June), reaching a new record of 192.3 million tonnes, underpinned by larger imports anticipated for Afghanistan, Iraq, the Islamic Republic of Iran and Turkey, to compensate for reduced production, as well as for Egypt, to replenish stocks. Among exporters, increased availability is seen boosting shipments from Argentina, Australia, the European Union and Ukraine, outweighing anticipated declines in sales from Canada, the Russian Federation and the United States, where supplies are forecast to be tighter than in the previous season.

Source: FAO